From Studio B at Advanced 8a, here's Mark Ryan and Kathy Vecksell. Hey Kathy, there are a lot of people out there that want to get SBA 8a certified. Let's talk about the qualifications for the certification so they can learn more about it. In order to qualify for the NA certification, there are five areas we will discuss that the SBA tests to determine if a firm is eligible. The firm must pass each of the areas, right Kathy? The areas are as follows: 1. Establishing the owner of the firm is socially disadvantaged. 2. Establishing the owner of the firm is economically disadvantaged. 3. The owner must not have any ethical issues and be free from ethical entanglements that might impair his or her judgment. 4. Establishing the owner of the firm has unconditional control of the firm. 5. Establishing the firm itself has the potential to complete federal contracts. That's right, Mark. Now let's talk about them in more detail. The first one is special disadvantage. Generally, to be socially disadvantaged, 51% or more of the firm must be owned by an individual or individuals that are both US citizens and at least 25% of their blood heritage comes from a recognized minority group. For Native American Indians, the test is the ability to provide proof of membership to the state or federally recognized tribe. Women, service-disabled veterans, Middle-Eastern Americans, as well as people who have a handicap can also be eligible. However, they have the additional burden of proving they are socially disadvantaged as they are not in a presumed group. That's right, Kathy. And similar to that, the second one is economically disadvantaged, which also applies to the owner. To be economically disadvantaged, the owner must establish they meet three financial criteria. First, he or she must have a three-year average...

Award-winning PDF software

Sba certification lookup Form: What You Should Know

SBA Guide: Small Business Administration — SBA Guide Search for SBA-certified small business organizations. For a list of the organizations in the database, please refer to the Small Business Directory SBA Guide: Small Business Administration — SBA Guide – ABBAS Provides information about many businesses, including an SBA-certified agency, to help find eligible small businesses, create a business relationship or acquire new firms, including: the Office of Management and Budget; the Small Business Administration; and the Trade and Development Council. SBA Guide: Small Business Administration — SBA Guide – ABBAS — Small Business Administration SBA Guide: Small Business Administration — Trade and Development – Trade and Development Council SBA Guide: Small Business Administration — Trade and Development – - Trade and Development Council Trade and Development Council — Trade and Development Council is the first agency within the USG designed to promote cooperation with foreign governments and businesses to reduce trade barriers and expand opportunities for business development and growth. SBA Guide: Small Business Administration— Trade Management (SMB TMC) — Trade Management Council Trade Management Council — This agency, supported by the Trade and Development Council, provides a range of activities, from information services to strategic advice and public outreach on trade issues. The Council also provides a clearinghouse of information on trade with foreign governments and other international organizations, as well as a website where international trade and economic issues are reviewed. SBA Small Business Investment Act Registry — If this is your first application, you will be asked to fill out an additional form to show financial status. SBA Small Business Investment Act — SBA AMIGA SBA Small Business Investment Act Registry — Provides details on the status of the SBA program, including who to contact regarding your SBA application. The SBA Registry is available online and also offers printout form. SBA Small Business Investment Act — SBA AMIGA — SBA AMIGA Program SBA Small Business Investment Bill of Rights — SBA SIR Pledge SBA SIR Pledge — Signed on June 27, 2007, this pledge guarantees that each SBA Small Business Investment Bill of Rights-funded program is administered in a manner consistent with the tenets of the SBA AMIGA Program.

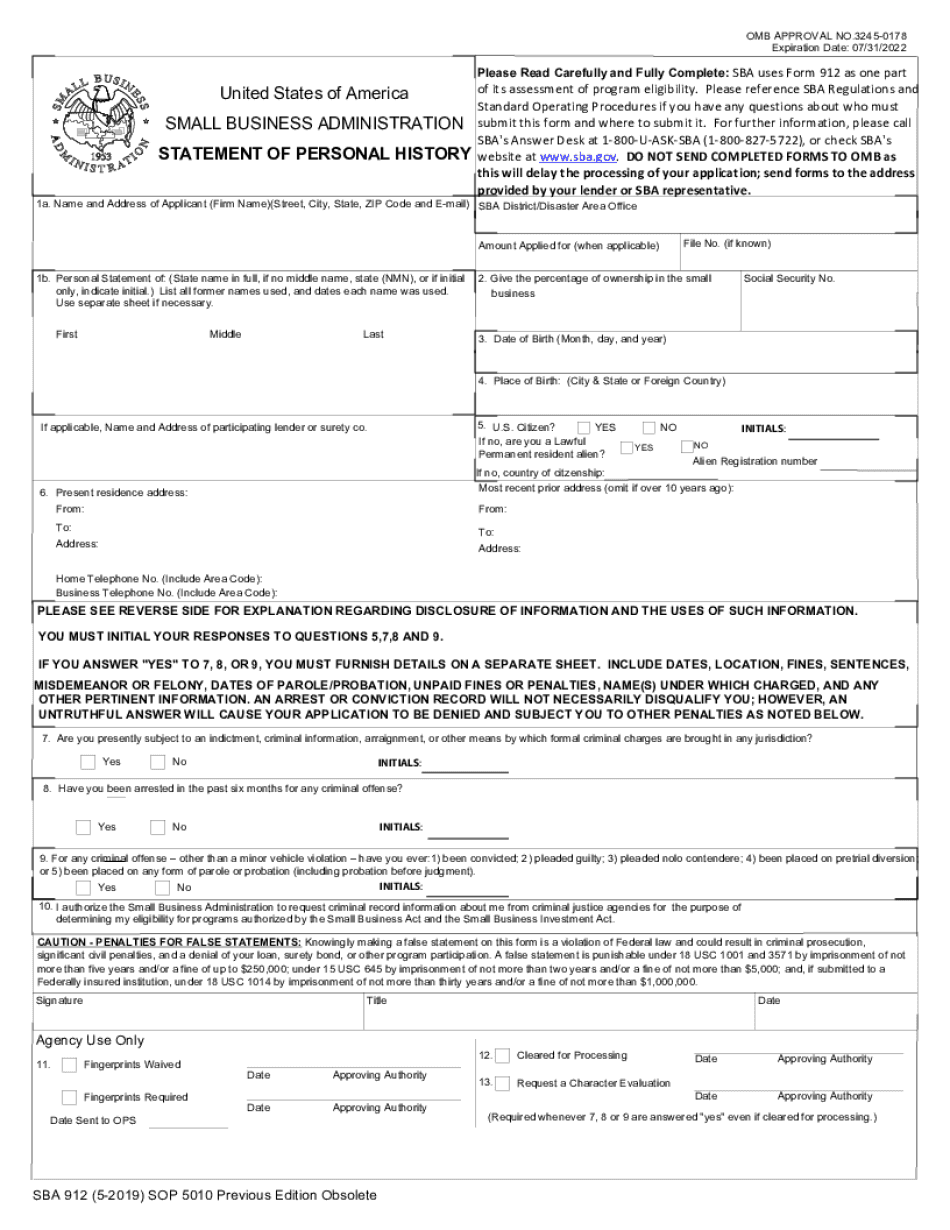

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 912, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 912 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 912 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 912 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba certification lookup