Award-winning PDF software

Sba surety bond guarantee program Form: What You Should Know

Safe Bond Guarantee Program A private surety has two options. It may do anything from do nothing to take an insurance company to court. A private surety can be given a safe bond if it agrees to write a policy. Here is a link to a form to complete and submit to the SBA. A surety company must use the following form to file a claim or write up a policy. Selling and Selling Surety Policies — SBA These are two documents which must be reviewed to understand the risks involved in doing business in the insurance business. Safe Bond Policy Review — SBA The SBA is an agency of the federal government that helps small businesses and businesses of all types improve their insurance offerings. Here is a link to some information on the SBA website. You can also see the Safe Bond Guarantee Program. A surety provider must use the following forms to complete a policy. No Bond Required, No Guarantee This is a short form that is used to indicate a surety company or agent has no bond required for the policy or the agent is accepting insurance companies that cannot or do not require a bond. A surety company may use this form as a means to obtain insurance. The following form may be filed with the SBA if you are seeking a safe bond. There is a small fee that must be paid per year or by the policy. No Bond Required, No Guarantee, and No Premium Guarantee — SBA This form must be completed, if an agent is seeking no bond, no guarantee, and no premium guarantee. This form can also be used if an agent is seeking a policy but is not accepting insurers at this time. The Safe Bond Program is designed to make sure that the Surety Bond Guarantee Program is fair, efficient and competitive and that it meets the government's goal of making sure that surety providers don't charge premium for these types of policies. The following FAQ's address a number of areas in which the SBA is concerned with making sure that companies provide reasonable and affordable care. Questions and answers in bold are used as resources to help people understand how the SBA is concerned with various aspects of the program. Questions and Answers Safe Bonds Question. What are Safe Bonds? Answer. Safe Bonds are a surety bond between a manufacturer or wholesaler and a private insurer. Question.

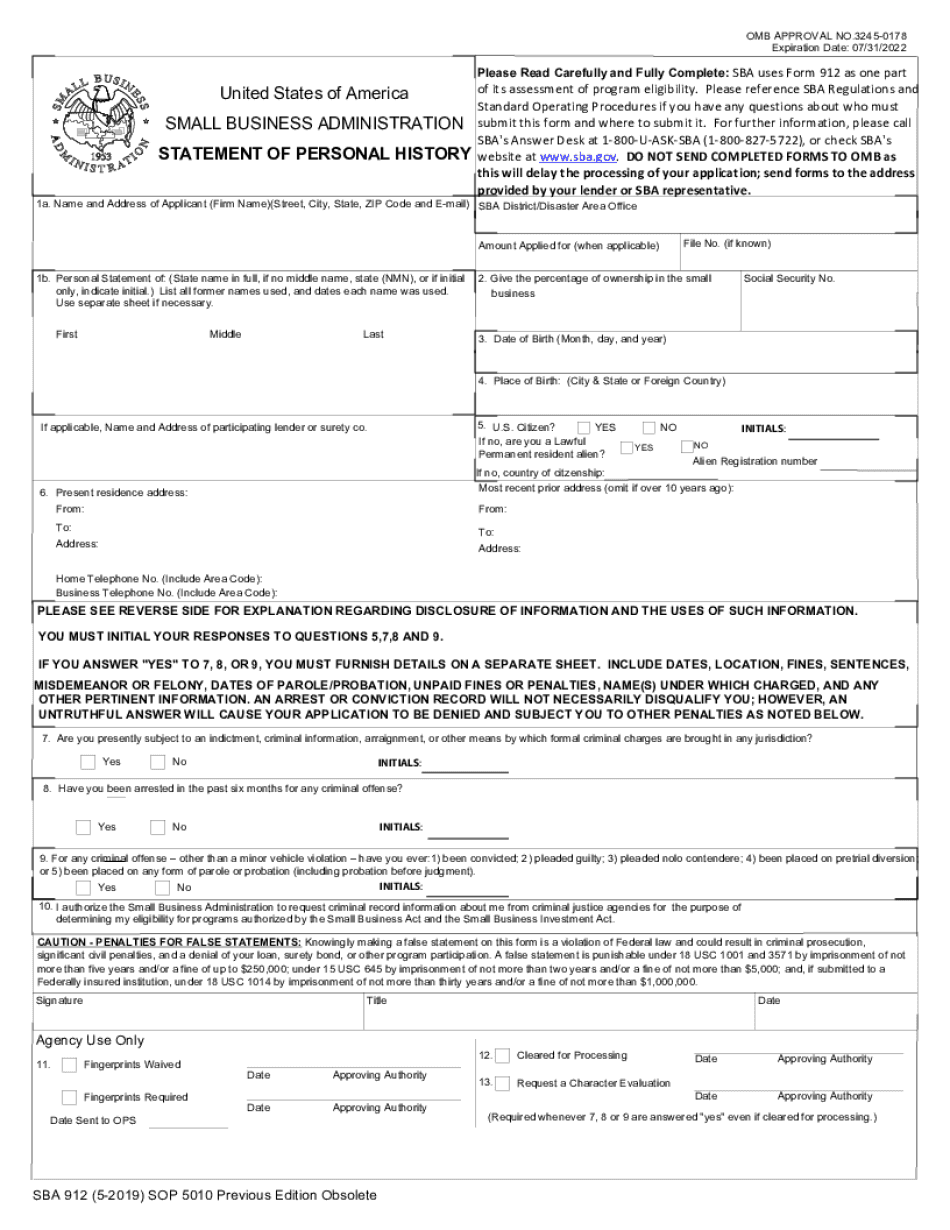

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 912, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 912 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 912 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 912 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.