Award-winning PDF software

How to prepare Sba Form 912

About Sba Form 912

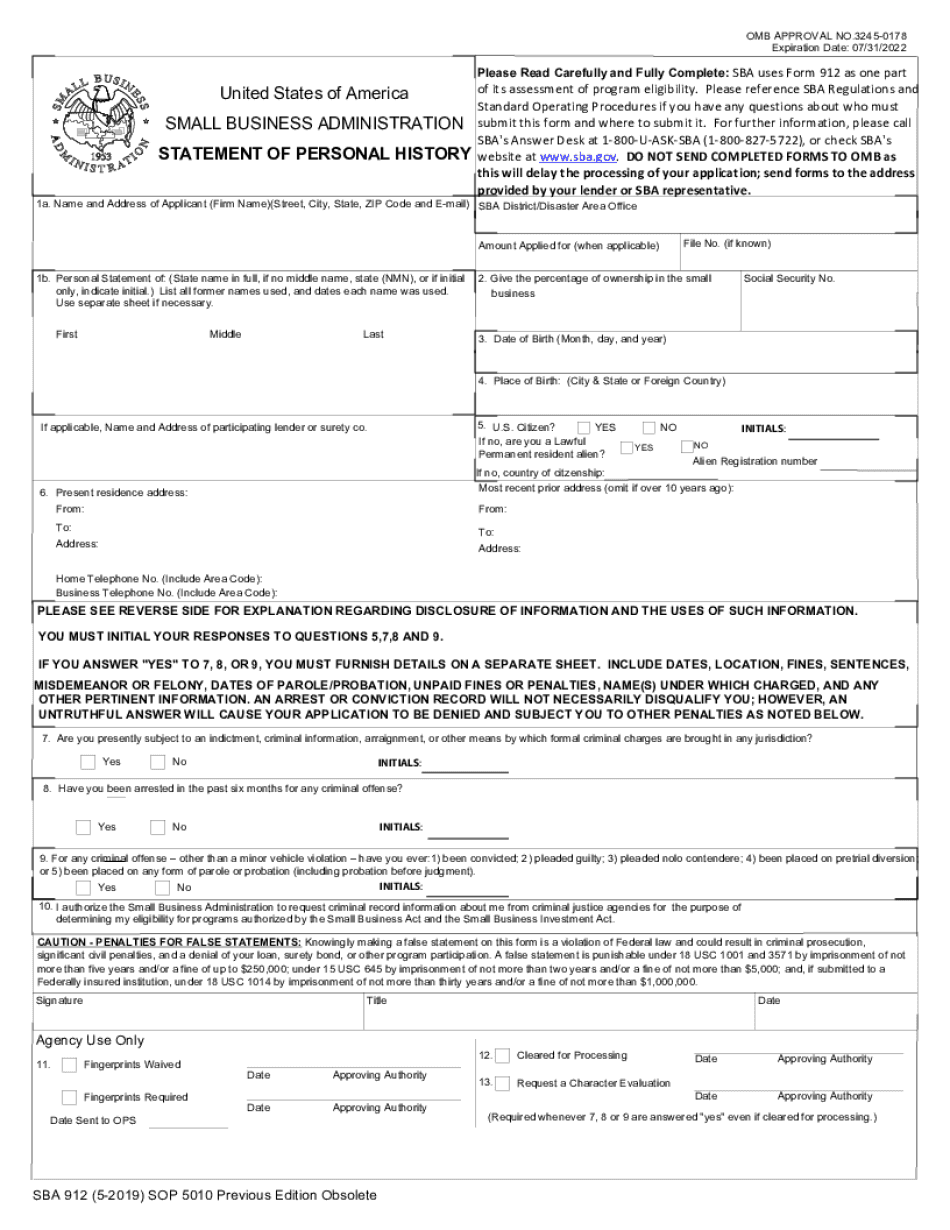

SBA Form 912 is a disclosure form that is required by the U.S. Small Business Administration (SBA) for individuals or entities that are seeking financial assistance or other transactions with the agency. The purpose of the form is to disclose any potential conflicts of interest between the applicant and the SBA. Any individual or entity that is applying for an SBA loan or other financial assistance, as well as anyone who is seeking to participate in an SBA contract or procurement opportunity, is required to complete and submit Form 912. This includes all owners, officers, directors, and key employees of the applicant organization.

Online solutions enable you to organize your document administration and enhance the productiveness of the workflow. Look through the brief information to fill out Sba Form 912, prevent mistakes and furnish it in a timely manner:

How to complete a Sba Form 912?

-

On the website with the document, click Start Now and pass towards the editor.

-

Use the clues to complete the relevant fields.

-

Include your individual data and contact information.

-

Make absolutely sure you enter proper details and numbers in proper fields.

-

Carefully review the content in the form as well as grammar and spelling.

-

Refer to Help section when you have any questions or contact our Support staff.

-

Put an digital signature on the Sba Form 912 Printable while using the support of Sign Tool.

-

Once blank is finished, click Done.

-

Distribute the prepared via email or fax, print it out or save on your device.

PDF editor will allow you to make changes to your Sba Form 912 Fill Online from any internet linked gadget, customize it in line with your requirements, sign it electronically and distribute in different ways.